Opportunities for Africans: Analysis of the Luminate Mid-Year Music Report 2025

TL : DR Summary

The USA Market is oversaturated. Focus will shift to underdeveloped markets in Africa. The Luminate Mid-Year report reveals interesting music trends that highlight the trajectory of Africa’s music ecosystems. In the context of the global music space, key shifts are happening based on consumer behaviour, fragmented audiences, technological adoption and more intentional collaborative efforts. While mature markets are seeing downtrends, such as the oversaturation of the USA market where digital sales saw a net-negative, regions like Asia, Africa, Asia, Latin America and the Middle East - once considered underdeveloped markets - are increasingly becoming centres of creative innovation and increased consumer engagement. This brief assessment focuses primarily on the opportunities available to African music practitioners and the strategies necessary to cement their position as growing role players in the global music ecosystem.a and Asia.

USA Market Overview

Over the past year, the US market has maintained a shift, with consumption habits leaning towards streaming. Streaming platforms remain the main source of positive growth with total consumption increasing by +3.9% from 537.9 million to 558.9 million. While on-demand audio streaming was the main growth driver, the market saw a decline in pure sales, declining between 3.2% and 17.7% across the board. This confirms the dominance of streaming over direct sales and is a contributor to the oversaturated state of the industry.

USA Market Trends

With streaming proving to be the main way audiences engage with artists in 2025, the genres and artists best represented on digital platforms in general are better primed to funnel users towards the music. Perhaps unsurprisingly, genres that are ubiquitous continue to maintain a prominent role when core listening trends are analysed. Still the epitome of ‘cool’ Hip-Hop is dominant for on-demand listeners, correlating with finding in the IFPI report. Via a streaming volume, R&B/Hip-Hop pulled 171.1 billion streams, followed by Rock and Pop.

Unpacking the African Opportunity

With increasingly sticky exports and genres like Afrobeats and Amapiano fuelling cultural waves, African music finds itself in a unique position in 2025. With the explosion of these genres and the talented artists associated with them, an opportunity to elevate the market has presented itself. According to Spotify in 2024 around 250 million user-created playlists now feature at least one Nigerian artist and 220 million contain a South African. This buoyed the industry and was accompanied by Nigerian artists receiving over $38 million in royalties while South African performers garnered $21 million, up an impressive 54% year on year.

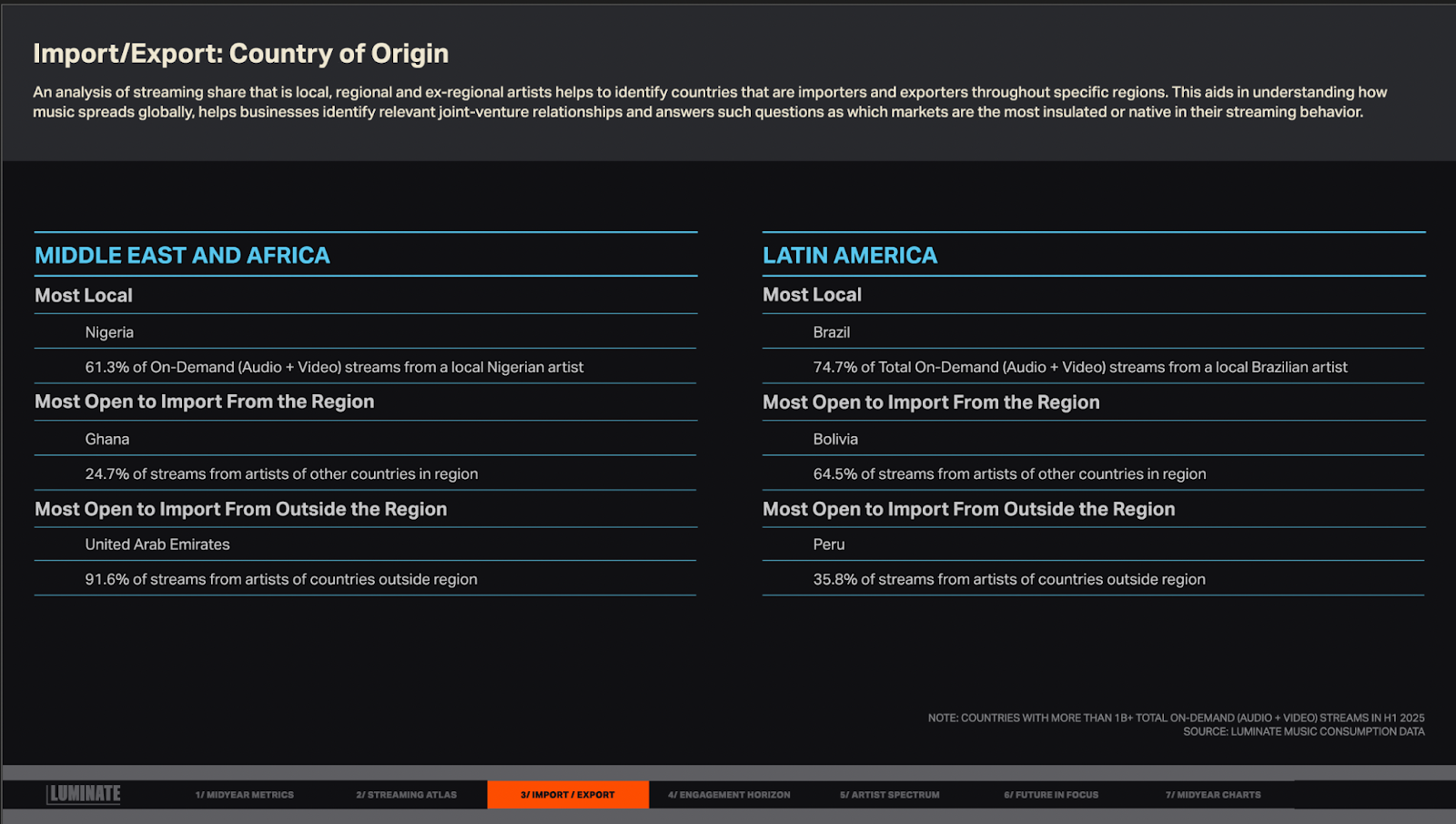

In the context of these impressive streaming figures, Nigeria epitomises the power of homegrown buy-in. With its dominance, Nigeria stands out as a fortress of local culture by recording a staggering 61.3% of local artists driving up music streams. This quantifies the intense passion and loyalty of the Nigerian audience. It positions the market as a cultural stronghold where breaking in requires deep, authentic collaboration and an understanding that you are entering a mature, self-sufficient ecosystem. Other markets will have to ingratiate themselves with Nigeria’s cultural scene to penetrate it.

Still in West Africa, an interesting nugget posits Ghana as the gateway for regional sound. In contrast to Nigeria, Ghana emerges as a key importer of regional talent with 24.7% of its streams coming from artists in other African nations. This makes Ghana a critical entry point for artists from across the continent looking to build a wider regional footprint. It is a market that is actively looking beyond its borders for the next big sound. Anecdotal observations point to this being influenced by Ghana’s “Detty December”, which has become a cultural touchstone for the diaspora during the December holiday, which is summer in Ghana. The other could also be a result of Ghana’s geographical proximity to Nigeria, coupled with Nigerian music’s incredible ability to export their culture and sound.

The New Battleground: From Streams to Super Fans

As previously untapped African streaming markets become more saturated, the real metric of success is no longer just the number of sales and plays, but the depth of fan engagement. Luminate highlights that only 18% of music listeners qualify as "Super Fans", those who engage with an artist in five or more ways, such as buying merchandise, attending live shows (virtual or in-person), or joining fan clubs. These are the fans who drive revenue and build sustainable careers. The question is, where do we find them? On the continent, physical purchases are incredibly niche and reserved only for superfans with disposable income. This reduces artists' opportunity to tap into their fanbase and is exacerbated by the fact that there are no longer any printing factories in South Africa.

Despite this, Afrobeats listeners stand out and are among the top three most engaged fanbases on Reddit and Twitch, and are the most over-indexed genre on WhatsApp. The next major solution for labels, managers and consultants such as us will be how to create a funnel that ushers these Superfans from engagement on WhatsApp to directly supporting artists despite the lack of ubiquity of payment solutions across the continent.

Opportunities in MENA & New Media

Afrobeats underindexing in the UAE is a sign that the market still has a lot of room to grow. The UAE is a critical strategic market for Sub-Saharan African artists looking to expand to Western Markets via the MENA region, tapping into the potential of its large, youthful population.

Afrobeats is also one of the only 3 genres to experience negative growth in the recorded period. However, the World music genre continued to grow. This is a powerful, actionable insight. While major labels focus on broad platforms, African artists have a unique opportunity to connect with their most dedicated fans on these more intimate, community-focused channels. WhatsApp, in particular, is a platform woven into the daily fabric of African life, and its evolution into a tool for artist-to-fan communication is a trend we must pioneer. This also speaks to how incorrectly identifying musical genres from African artists leads to “dirty” data, which makes tracking the actual growth or contraction of Afrobeats difficult. At the time of writing this report, the Billboard Afrobeats chart (which provides the data for Luminate’s reporting) has a Dancehall song by Moily at number 1 and a house song by American Pop star Camilla Cabello at number 3.

Afrobeats artists over-indexing amongst podcast listeners also provides a clear opportunity for artists looking to expand their audience. Finding ways to get featured on music-related podcasts is an avenue worth exploring, with an anecdotal example of this being Joe the Budden's Podcast boosting Elaine’s “You're The One” single.

AI & The Future of African Artistry

African Artists are facing precarious headwinds, especially when trying to break into the world's biggest market. While 33% of US listeners are comfortable with AI creating song instrumentals, over 70% of listeners are uncomfortable with AI composing original songs. The rise of fully AI-generated acts like The Velvet Sundown and Aventhis, who are already generating significant streams, is a direct challenge to the definition of human artistry.

For African creatives, this is an immediate strategic consideration. Our competitive advantage has always been our authenticity, our unique sound, and our culture. This will force artists to continuously evolve sounds and genres to stay ahead of generative AI models, which will commodify the African sounds as fast as they are being produced by humans. Now more than ever, it is imperative that African artists create unique sounds instead of replicating popular Western genres.

Strategic Takeaways

Nigeria consumes Nigerian

Ghana is open to other sounds

Shift budgets from chasing passive streams to engaging superfans

WhatsApp Channels and Fan Groups are essential

Future-proof your artistry in the face of AI

For the African market to continue its expansion, the ecosystem must develop market-specific strategies based on localised consumption habits. The Luminate report shows an appetite, both locally and internationally, for increased engagement with the music. The industry should consider shifting from broad streaming numbers to cultivating super fans through both hi and low tech solutions, including digital engagement on community-driven platforms like WhatsApp. African artists should develop tailor-made strategies to leverage the unique trends in countries like Nigeria, where hyper-localisation is the norm and Ghana, where the audience is more inviting to outside influences. The African music industry also needs to actively prepare for the impact of AI by prioritising authentic and evolving sounds. By focusing on these strategic areas, African artists can navigate the evolving music landscape and build sustainable careers. A holistic approach to trends, data and cultural nuances should be paired with increasing fan loyalty, aiming for long-term monetisation and building authentic brands.